Incentives Update

13th December 2013

Further to our Energy Update last month, there have been a number of recent announcements worthy of note. As ever, developments continue to be fast-paced but the following may provide some season’s cheer to some in the sector.

CfD Strike Prices Update

On 4 December DECC published its ‘Contracts for Difference contract terms and strike prices’ update.

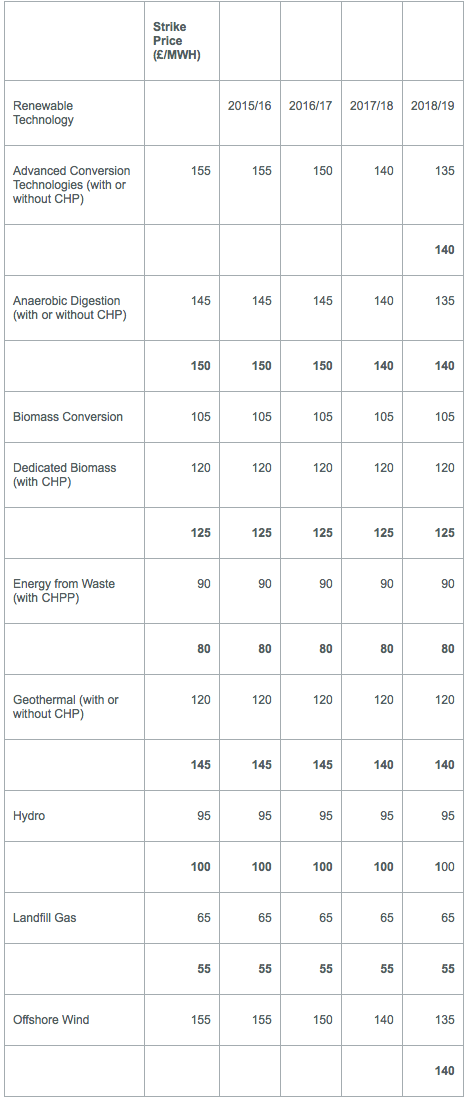

In our article ROCs or CfDs – the choice is not clear cut we considered the draft CfD strike prices published by DECC and evaluated the risk profiles between CfDs and the Renewable Obligation (RO). DECC has now set the strike prices for 2014/15 – 2018/19, declaring that “CfDs will make it cheaper to deliver low-carbon generation by lowering the cost of financing projects; reductions that cannot be achieved through existing policy instruments, such as the RO.”

DECC therefore appears to be confident that the strike prices will provide sufficient investor and industry certainty, but how certain really is this? The following table sets out the draft strike prices and the confirmed strike prices in red where they have changed (however it is noted that these are in all cases maximum strike prices and that the actual strike price may be determined with reference to the constrained allocation process if that is a lower value).

The announcement also includes some “key points on contract terms” which confirm that the overall approach to the standard CfD contract term will be for 15 years for renewable technologies, with payments indexed to inflation and obligations relating to the timing of delivery of the contracted capacity. The following has also been confirmed which the Government says supports “the ability of developers to bring forward investment at lower cost to consumers”:

Developers will be allowed to reduce their proposed capacity after signature of the CfD to allow for refinement of plans, and problems during construction and commissioning.

Developers will be protected by contract provisions anticipating certain unexpected events including delays caused by connection, geological conditions and environmental issues.

There will be extended protection in respect of change in law to include revenue adjustments should the generator be prevented from generating without receiving reasonable compensation. There will also be strike price adjustments to compensate for changes in charges covering transmission losses and balancing services costs.

The Government will provide generators with the option to switch to a year in advance reference price when it is introduced.

The announcement has placed a bit more flesh on the CfD bones however the industry will still be keen to see further detail in the publication of the EMR Delivery Plan later this month.

Non-Domestic RHI Tariff Update

The Government has also published an update to the non-domestic RHI tariff. In summary, support will be increased for renewable CHP, large biomass boilers (over 1MW), deep geothermal, ground source heat pumps, solar thermal and biogas combustion. It was also announced that there will be new support for air-water heat pumps and commercial and industrial energy from waste. The Government has made it clear that the revised tariff figures are now based on “refreshed market intelligence” rather than the pre-scheme expectations.

*These tariffs are subject to an inflation based increase in April 2014 (RPI linked) but may also be subject to degression before April 2014 in accordance with the current budget management policy.

**CHP will continue to be eligible under the large biomass tariff, which includes the proposed increase from 21st January 2013, until it becomes eligible under the dedicated CHP tariff from the date of publication.

The new tariffs will apply from Spring 2014 (anticipated to be 1 April), subject to the usual Parliamentary processes and state aid approval.

2014 will also bring the full review of the RHI and stakeholders may take some comfort from the Government’s announcement that they intend to “avoid making any changes to the new tariffs set out here and not to open up fundamental questions regarding the tariff setting methodology.”

Feed-in-Tariff Review for Small Scale AD?

Greg Barker has announced that the Government will consult on measures, including the possibility of a tariff review, to ensure that the small-scale anaerobic digestion sector is not ‘unfairly disadvantaged’ by the anticipated Feed in Tariff (FIT) degression for <500kW anaerobic digestion (AD) plants. This news follows earlier confirmation from DECC that the capacity trigger for AD plants of this scale had been reached and therefore that degression would be initiated in April 2014.

Whilst the Government has noted that the legislative timetable means that no action can be taken before the January announcement of the 20 per cent. degression to the FIT (due to take effect in April 2014), the industry has very much welcomed the news. The review acknowledges flaws in the FIT degression model for AD (largely that greater capacity plants have contributed towards the trigger point, leaving the genuine small-scale AD sector “yet to reach its full potential”), but that Greg Barker’s announcement “gives the Government a good chance of fixing the situation”.