ESG and climate reporting

14th September 2021

The ESG (environmental, social, governance) agenda – embedding sustainability and responsibility in the ethos, operations and reputation of the business – is one of the biggest boardroom issues of the day. A key facet of that is understanding and complying with climate reporting obligations.

In many cases, organisations are required to report on environmental- and climate-related aspects of the business and on the business’ impact on the environment as a whole. There are also specific rules and regulations, applicable to certain companies, which require additional reporting on discrete environmental matters, such as greenhouse emissions, water discharge, and so on.

Over and above the purely legal framework, many businesses are also becoming increasingly commercially and socially motivated to voluntarily provide additional reports and claims relating to their environmental and sustainability ambitions.

Against this complex regulatory and commercial backdrop, Walker Morris partner and Energy specialist Ben Sheppard explains essential and recommended reporting requirements, and offers his practical advice.

What must be reported?

The first step to achieving a comprehensive climate reporting approach is to comply with mandatory reporting requirements. The below checklist will assist:

Voluntary reporting: Getting ahead of the game

Investors, employees, other stakeholders and society as a whole are driving the need for all businesses to address the climate agenda. Quite apart from the fact that recent years have seen an unmistakeable cultural shift towards a global community with an increasing social and environmental conscience, a recent survey carried out in the US [3] found that 78% of consumers were more likely to buy a product if it had ‘green’ credentials [4]; that 75% of millennials would pay more for a green product and that 76% of people would even switch from a preferred brand for sustainability.

Getting ahead of the game by additional voluntary climate-related reporting can therefore be an effective commercial strategy.

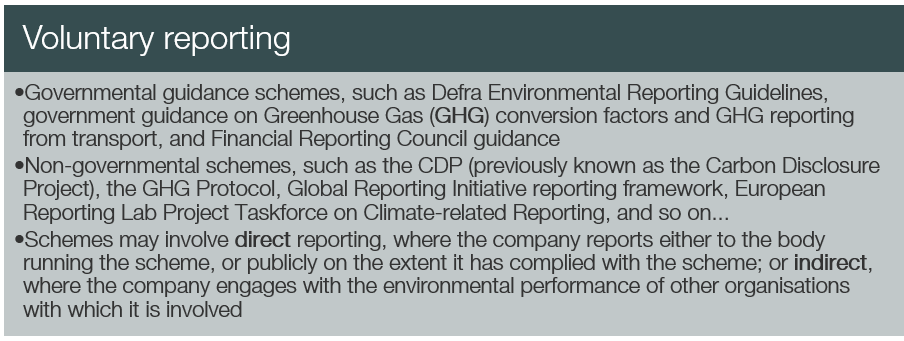

The scope and nature of voluntary reporting that a business may wish to provide will differ from business to business and will depend on the type of voluntary commitments made at board level. Schemes for reporting which businesses may choose to adopt currently include (non-exhaustively):

What is on the horizon?

The government’s July 2019 Green Finance Strategy includes an expectation for all listed companies and large asset owners to disclose in line with the TCFD recommendations, made within the TCFD’s June 2017 report, by 2022.

In November 2020, the government announced that it intends to make it mandatory for large companies and financial institutions across the UK economy to make climate-related disclosures aligned with the TCFD recommendations, by 2025.

The TCFD published an interim report setting out a path over the next five years towards mandatory climate-related disclosures. The ‘roadmap’ sets out a strategy for listed commercial companies; UK-registered companies; banks and building societies; insurance companies; asset managers; life insurers and FCA-regulated pension schemes; and occupational pension schemes. The TCFD’s recommendations underpin the roadmap, and focus on:

- Disclosing the organisation’s governance around climate-related risks and opportunities;

- Disclosing the actual and potential impacts of climate-related risks and opportunities on the organisation’s strategy and financial planning;

- Risk management – disclosing how the organisation identifies, assesses and manages climate-related risks; and

- Disclosing the metrics and targets used to assess and manage relevant climate-related risks and opportunities.

(There is some overlap between existing UK climate-related reporting and disclosure regimes and TCFD recommendations.)

In terms of Brexit impact, whilst EU Directive 2014/95/EU (the Non-Financial Reporting Directive, NFRD) is part of EU law being retained, the Corporate Sustainability Reporting Directive (CSRD) does not form part of the UK’s International Financial Reporting Standards post-Brexit. It may be, however, that the CSRD sets a benchmark with which the UK will nevertheless align in time. The scope of the CSRD is proposed to include all large companies, whether listed or not and without the previous 500-employee threshold, as well as listed SMEs (with the exception of listed micro-enterprises), and may therefore create obligations for such businesses. This area is ‘one to watch’ and Walker Morris will report on key developments.

What practical advice arises?

Whilst undertaking legally/regulatory-compliant and commercially valuable climate reporting may appear, at first glance, to be quite complex, there are certain practical steps which businesses can take to help make the apparently unmanageable task, eminently manageable and effective. For example:

- Becoming familiar with the TCFD’s recommendations will enable businesses to understand these key recommended climate-related disclosures and to identify the internal systems and procedures needed to ensure future/ongoing compliance. A key part of this process may be educating the board as to the recommendations and how they may impact upon the business’ governance, risk and strategy.

- Conducting a risk assessment in relation to climate change issues will enable the business to map risks and its existing climate governance policies against CA 2006 and other mandatory [and voluntary] environmental and climate disclosure requirements. In turn, any overlaps, differences and gaps can be identified, and addressed.

- Understanding climate-related risks can also inform the development of a strategy for identifying and capitalising upon potential opportunities.

- Establishing, and educating staff as to, systems for the recording of all climate-related data will facilitate future reporting/disclosures.

How we can help

Walker Morris is a multi-disciplinary commercial law firm, with specialist lawyers experienced in corporate and climate reporting, as well as all other aspects of the ESG agenda.

We can work with businesses at every step of their journey to create, implement and deliver an effective ESG strategy.

Contact

Please do not hesitate to contact Ben for further information or advice.

[1] that is, not small under section 382, or medium-sized under section 465 of CA 2006 (SMEs)

[2] under section 385 CA 2006

[3] GreenPrint survey, February 2021

[4] See our recent briefing on how can businesses ensure that their ‘green’ claims comply with consumer protection legislation for further information and advice in this area