Getting the price right: Price adjustment mechanisms in corporate transactions

6th January 2023

Getting the purchase price “right” when buying and selling a company is understandably one of the main, if not the main, concerns for both buyers and sellers. It can also be a cause of contention and lead to transactions failing to complete. It is therefore important to understand the mechanics for agreeing the purchase price and to understand how to use price adjustment mechanisms.

A buyer’s opening offer will often be adjusted depending on the target company’s actual financial position on or around the date that the deal completes. This tends to be because the buyer’s initial valuation of the target company is based on a number of assumptions and historical financial information. In these circumstances, a price adjustment mechanism will need to be agreed to determine the final purchase price for the shares.

This article explains the purpose of price adjustment mechanisms and the key differences between the two main approaches adopted, namely “completion accounts” and a “locked box”.

Enterprise value and equity value

The process for working out the purchase price begins with the parties agreeing a headline price for the target company (typically referred to as the enterprise value). The headline price is based on the buyer’s initial valuation of the target company and represents the total cost to acquire the target company (i.e. the cost to acquire its shares and take on responsibility for any debt financing). It is therefore not necessarily the amount that will be paid to the seller for the shares (typically referred to as the equity value).

The buyer will often apply a number of assumptions when valuing the target company. For example, that the target company will be acquired with no cash, no debt and a normal level of working capital. The buyer will usually want to test these assumptions and adjust the price it pays for the shares for any differences between its assumptions and the target company’s actual financial position at an agreed date. This is where price adjustment mechanisms come into play.

The overriding purpose of a price adjustment mechanism is to bridge the gap between the target company’s enterprise value and equity value, and, as a result, determine the purchase price payable to the seller for the shares. The following is an example of how this works in practice when the enterprise value has been calculated on the assumption that the target company will be acquired on a cash-free/debt-free basis and with a normal level of working capital:

In this example, although the headline price was £60 million, the purchase price payable to the seller for the shares after making adjustments for cash, debt and working capital would be £50 million. This is because the buyer is acquiring a company whose: (i) actual working capital is valued at £3 million less than what is agreed between the parties as being a “normal” level; and (ii) net debt position is £7 million less than the assumed level of £0.

One of the key points that needs to be agreed is the date on which the cash, debt and working capital is measured. This will determine whether it is a completion accounts or locked box deal.

Completion accounts

Where the parties agree to adopt completion accounts as the price adjustment mechanism, the final purchase price/equity value will be determined by reference to a set of accounts that show the target company’s financial position as at the date of completion of the deal (the completion date). These accounts are prepared and agreed post-completion, meaning that the final purchase price is unknown at the completion date. This is generally seen to be more favourable to a buyer, who buys the company with the knowledge that the price it pays will reflect the actual positon at completion.

The following points are typical of completion accounts deals:

- the buyer will make an initial payment to the seller on the completion date based on agreed estimates of cash/debt and working capital;

- an adjusting payment will be made by either the buyer or seller post-completion to reflect the target company’s actual cash, debt and working capital position on the completion date;

- the completion accounts are usually prepared specifically for the transaction (i.e. they are not statutory accounts), meaning that the parties will need to agree the basis upon which they will be prepared, including what is included in the definitions of cash, debt and working capital; and

- the adjusting payment will not be paid until the completion accounts have been prepared and agreed, or determined through a disputes process set out in the sale and purchase agreement.

Locked box

The locked box price adjustment mechanism involves calculating a fixed purchase price prior to signing the sale and purchase agreement. The purchase price is determined by reference to a set of accounts made up to a date before the completion date (known as the locked box date). The accounts used will typically be the target company’s latest statutory accounts, but could also be the latest management accounts or a set of accounts prepared specifically for the transaction.

Unlike a completion accounts deal, the target company’s financial position will be known prior to the completion date. As a result, there are no adjustments to the purchase price post-completion; the adjustments are agreed and made pre-completion. This is generally seen to be more favourable to a seller, who then has certainty as to the equity value before the deal is completed.

Some of the key points to note on locked box deals are:

- the economic benefits and risks in the target company pass to the buyer on the locked box date (i.e. before the deal has completed);

- the seller will be restricted from doing certain things that could leak value from the target company to the seller during the period from the locked box date to the completion date (known as the locked box period) unless permitted (e.g. the seller will be prevented from paying a dividend during the locked box period);

- if the seller breaches its leakage obligations, the buyer will usually have a £ for £ recourse against the seller; and

- unless otherwise provided in the sale and purchase agreement, the purchase price will not be adjusted for any uplift in or deterioration of the target company’s performance during the locked box period.

Advantages and disadvantages

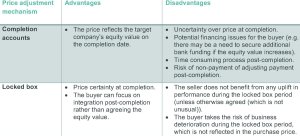

When deciding on the appropriate price adjustment mechanism for a deal, it is worth taking into account, amongst other things, the following advantages and disadvantages of the completion accounts and locked box mechanisms:

How we can help

The Corporate team at Walker Morris has extensive experience and expertise in drafting and negotiating corporate transactions with completion accounts and locked box price adjustment mechanisms. If you would like to discuss a prospective sale or purchase of a business, please just get in touch.